Portfolio Update (Apr 2022) | Winter Is Coming

Well, this has got to be the most exciting month of the year. The latest news has got to be the crashing of LUNA , FED raising the interest rate by half a percentage point that led to the broad markets coming down.

Personal

- Work. Got assigned to a new project on top of my core work - will be a good learning opportunity and exposure. Learning curve is steep at the start due to and it will take up quite a bit of commitment until the next year.

- Health and Fitness. Been contemplating on getting a bike for a few months and I finally got myself one off Carousell - an entry level decathalon road bike. A good way to explore different parts of Singapore while getting some exercise.

- Travel. Finally after 2.5 years, I've booked my first overseas trip for End May. Though its a short 3D2N trip to Kuala Lumpur, am excited for it. Fingers crossed that I stay COVID-free until flying off!

LUNA/UST Crash

If you have been follow social media, you would be definitely heard of this epic crash. From a high of 119.38USD just over a month ago, LUNA is now trading at a mere 0.0002316. The extent of this crash will definitely spook even the most seasoned investors.

Unlike stocks which have real businesses creating value to people, crypto does not produce anything. Crypto's value comes from the people - demand and supply forces at work. In the case of LUNA, people just lost the trust in LUNA/UST due to pegging issues.

What we can learn from this episode is things happen super fast in the crypto space. Have a clear plan what happen during a doomsday scenario and limit your exposure to an allocation you are comfortable with.

Portfolio Update

Growth Portfolio

BABA continues to hold the support at ~80 USD despite all the bad news. Will be holding on to this for the long term and wait for the eventual turn.

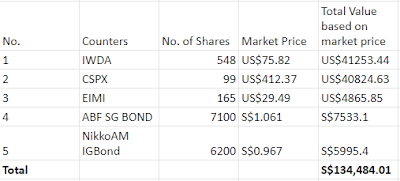

Index Portfolio

Increased my monthly investment to S$3500. S&P 500 is currently down ~16.5% from ATH. Key levels to watch would be 395 and 72.19 (-20% down from ATH for CSPX and IWDA respectively).

Strategy is to spread out my warchest and invest additional sum when CSPX and IWDA are down at 20%, 30% etc.

Yield Portfolio

Sold: Centurion. With interest rates rising and set to further rise in the year, key concern will be if companies will be able to handle the higher costs (and debts).

With a possible recession, I would prefer companies that have solid balance sheet that can weather the days ahead.

Being a smaller company and a servicing ratio that is close to my threshold of 30%, I took the opportunity to sell off during the recent surge in price.

Would be looking to add more REITS (minimally 5% yield) slowly over this period.

Final Thoughts

It has been ~2 years since the last major downturn and some of the stock prices are beginning to look attractive. If there is something that I've learnt from the sudden COVID-19 induced crash was that no one knows where is bottom and we dont need to exactly go in at the bottom.

Its unsettling to see your portfolio going down in value, but importantly is to stay consistent.

If you're investing in index funds, continue to add on your monthly investments (add in more if you can afford) and dont take a look until the next month.

For active investors', do your homework on the price target, have a plan to allocate your warchest and take action when the time comes.

Til the next time, stay safe!

No comments: