Portfolio Update (March 2022)

It's been a while since the last post, many things happened on both personal and work fronts. Its been a roller coaster ride of emotions, now that things have stabilised, will resume with the monthly updates.

Month in Review

Personal

- Demise of loved ones. Goodbyes are always hard, especially when it's so sudden. Cherish time with loved ones and take time out of your busy schedule to spend time with people that matters.

- Work. Switched into high gear in Mar/Apr - sent for a work trip. Great exposure, able to work under one of the best bosses; learnt different perspective and way of thinking when approaching issues. Received an higher than expected performance bonus, blessed to receive recognition for the hard work last year.

- Health and Fitness. Been consistent with my runs and static exercises until mid March when work started ramping up. Had not been exercising for about a month and it was tough to get started again! Will be resuming the exercises today and see if I can hang in for a month, until the habit starts kicking in.

Omicron Virus

Finally after ~2 years, the COVID regulations have relaxed to pre-covid times. Its heartening to see the community bustling again - we've come a long way since then and managed to emerge stronger from this pandemic. Air travels are reopening and that will be something to look forward to this year.

Markets Tanking

Mr Market definitely does not like the sound of the ongoing Ukraine war, FED rate tax hike, rumours of recession looming. Markets continue to fall and this shouldn't be a surprise as we have been on an upward trend for a very long time.

Portfolio Update

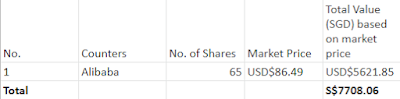

Growth Portfolio

China Tech continues to stay depressed, it's likely to stay this way for a while until a catalyst sparks interest again in this sector. Will not be adding further to maintain below 5% of portfolio allocation.

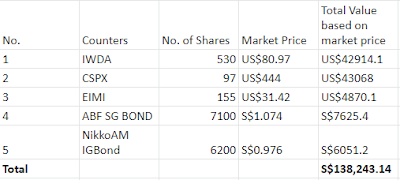

Index Portfolio

Continued with S$2500 monthly investment - slow and steady, despite all the bad news, still up by 20%.

Yield Portfolio

Was waiting for REITS to dip a little further since the last update but it didnt happen - Prices continued to soar even higher! With REITS and banking stocks trending higher, would be consolidating cash and wait patiently for the next dip.

As air travel opens up, CDG and SATS would benefit from this. Fingers crossed things will slowly improve to pre-covid within the next year.

Final Thoughts

Looking forward to a staycation next week during the long weekend. Possibly a short holiday overseas in the 2nd half of the year. In the meantime, hustle hard, spend quality time, stay invest and take care!

No comments: