Hi Everyone,

If you are on a FIRE journey or simply investing for retirement, one of the question that we have to ask ourselves is how much is sufficient?

The usual amount that we perceive we need is S$1,000,000; but is it sufficient to sustain our future lifestyle.

Calculating your Expenses

In order to obtain the FIRE number, we first need to figure out how much we spend in a year. Logically, the lower our expenses, the lesser the amount of money we need to amass.

One difficulty when calculating our expenses would be forecasting how much we would need in the future.

What we think we might need now, might not be the same in the future. For example, if we require a car in our course of work, once we retire the car might not be essential and can be sold off thus reducing future expenses.

Also, variables like inflation are out of our control, which will affect the amount of money we need to set aside to sustain our future lifestyle.

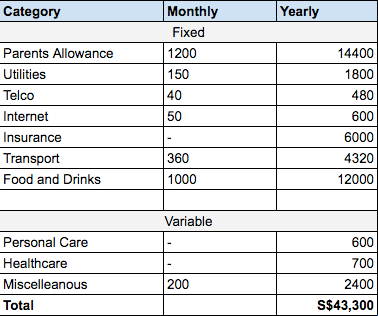

As what Millenial Revolution always say, we need to math this shit up! I will breakdown the expected expenses per month into 4 parts: (1) Couple living together requiring basic necessities, (2) With discretionary spending like travel, (3) With a Car, (4) With a Child

Alright, let's get cracking!

The Fixed

Food and Drinks

According to our tracked expenses, we don't spend more than S$400 per pax on food and drinks. This is a very comfortable amount that includes the occasional restaurant meals.

When we have our own house in the future, likely we will be cooking more of our own food - allocating additional S$200 to this.

Annual Cost: S$12000

Transportation

Although Singapore is a small country, we have 6 MRT lines with plans to build the 7th one (Cross-Island Line). This makes travelling within Singapore very convenient. Also, there are various transportation options like buses and taxis to choose from, which are not very expensive.

Monthly expenses on public transport is estimated to be ~S$80. Catered additional S$100 per month for Taxis / Bluesg for areas which might not be easily accessible or takes an unproportionate amount of time if we were to take public transport rather than driving there.

Annual Cost: S$4320

Utilities

Being able to choose from different electricity provider has helped lower the monthly cost of utility. Current bill for a family of 4 with no air con usage is roughly S$150. Allocating S$150, inclusive the use of aircon for 2 pax.

Annual Cost: S$1800

Telco and Internet

The telco landscape has changed over the years, with the introduction of many new operators, telco bills have become much affordable. Long gone are the days where we have to pay S$35 for a 2gb plan. Nowadays we can easily get a 40gb SIM only plan for S$20. 1Gb Home fibre is also available at an affordable price of S$50.

Annual Cost: S$1080

Insurance

Another recurring expense, albeit one of the more important one. It is essential to have insurance in order to protect our family's livelihood as well as to not be burdened with bills if something untoward were to happen.

Life Insurance, Hospitalisation, Critical Illness, Disability income, accident plan forms the basis of my insurance plans. In each plan there are differences in coverage and premium, so do really look in detail to ensure you are adequately covered yet not overpay for unnecessary add-ons.

Plans like Hospitalisation tends to increase as we age, so it's hard to pinpoint the exact amount required per month.

Annual Cost: S$6000

Parents Allowance

Even if we were to FIRE, it is good gesture to continue giving some allowance to other parents even if they do not need it.

Monthly: S$1200, Yearly S$14400

The Variables

Personal Care

Inclusive of haircut, toiletries, facial products etc. Allocating S$50 a month.

Annual Cost: S$600

Healthcare

Currently our job covers us with yearly health check-up and allowance for dental services. Including this amount for the future when the benefit cease to cover us.

Annual Cost: S$700

Miscellaneous

Occasional treats, birthday gifts, weddings, electronic gadgets etc. Allocating S$200 a month for these one off events.

Annual Cost: S$2400

FIRE Number For Basic Living

Now after adding all of the above we have...

... S$43,300! The amount that we need to have an okay-ish standard of living in Singapore for 2 pax.

This number does not include the amount required by housing (which we will be incline to pay fully using CPF).

If we were to use the

4% rule as a guide, we would require

S$1,082,500. Pretty close to the general assumption of 1mil.

This amount could be higher if we were to use a more conservation withdrawal rate (to have 100% certainty that we do not run out of money during retirement) or lower if we were to have investments that yield more than 4%.

FIRE Number (Inclusive of Travel)

What is life if we can retire early but not be able to indulge in worldly experiences like travelling. Assuming that we have a 2 trips in a year (1 short one to nearby countries like Malayisa/Thailand/Indonesia and 1 long haul trip) estimated to be S$4000 per pax.

Annual Cost: S$8000

Adding on this number to our base FIRE number, we would require: S$51,300 which translates to a portfolio with S$1,282,500.

FIRE Number (Inclusive of Travel and Car)

Everyone knows that owning a car in Singapore is insanely expensive compared to many countries in the world but it comes with its own convenience.

Annual Cost: S$15,000

Our annual cost will now be S$66,300 and require a portfolio of S$1,657,500.

FIRE Number (Inclusive of Travel, Car and Having 1 Child)

It's still far before I plan to have my own child, but roughly knowing the cost of raising a child would give us time to plan ahead. Based on

this article, the cost of raising a child is approximately

S$1000.

This amount does not include enrichment classes or employing a helper to look after the child.

Annual Cost: S$12,000

Inclusive of the basic necessities, travel, car and 1 child would cost S$78,300. If we aspire to FIRE with 1 Child, we would require a portfolio of S$1,957,500.

Conclusion

I certainly had a better clarity of the amount that I would to have based on my various life choices.

The amount might look large initially but I think it is definitely achievable for millennials who are just starting their financial journey.

Assuming a millennial who graduated at age 25 with S$10000 investments and adds S$1000 monthly over 30 years at 6% interest, he/she would have S$1,063,055 at the end!

If we want to propel our FIRE journey, we would need to invest more as our salary grows over the years.

With consistent savings, income growth, avoid getting into unnecessary debt/spending, the FIRE dream is definitely within reach.

Oh yes, there is still CPF payouts in our later years, so that definitely gives us a little more buffer.

For now my fire number will be S$1,957,500 - better to be more conservative than to fall short when the time comes.

What's your FIRE number?

Hi FinancialToast,

ReplyDeleteA good write up there. Its always good to start identifying early, the items and their associated costs of what we would need in our retirement. Although things will change, as life has a habit of throwing curve balls at us, doing this exercise will still give us some idea of what to expect, what we need to have and how far or how near we are to our desired savings goal to meet our life's aspiration.

As a 60 yo, I would like to share some more pointers to help in your planning:

1. Retirement expenses are not constant throughout. For example, in our retirement planning, we expect to do a lot of travelling in our first years in retirement. Then by 70, we would cut down those travelling but we would want to still own a car till 75. By 80, we would probably be employing domestic helper to help in the household chores. So in our first few years in retirement, we are expecting to spend $150,000 to $160,000 a year. At 70, the yearly expense would reduce to $120,000. And so on and so forth.

2. Remember to factor in inflation. In our planning, we used 3% inflation rate a year. Then do a sensitivity study on the effects of varying inflation rates to understand its impact on the expenses an your cashflow. A 1% increase in inflation rate can screw up a retirement plan with little to no buffer!!

3. To live our aspired retirement lifestyle over 30 years, the calculation showed we would expend $6.6M!! The question is do we need this $6.6M upfront !? The answer is no! As long as you can make your current savings generate the cashflow to meet your yearly expenses, one does not need to have the full retirement expenses over, say 30 years, upfront.

So for our case, we have the following cashflow:

1. Dividend income at $65,000 a year

2. Rental income at $36,000 a year

3. Drawdown from our SRS at $49,000 a year over 8 years (62 to 69)

4. Interest from our CPF OA&SA at $58,000 a year

5. CPF Life payout at $48,000 a year from 65 onwards

4. Identify the weak from the more robust cashflow. Obviously the dividend and rental incomes are market dependent. So it is definitely safer to plan a retirement lifestyle around the more robust sources of cashflow namely, the CPF & SRS sources. For us we treat the dividend and rental incomes as bonus to enjoy the little extras in our retirement.

All the best in your wealth building journey!

Hi mysecretinvestment,

ReplyDeleteThanks for providing such a detailed insights on your retirement planning - definitely help on the various conditions that I did not consider in the article!

Yes, projection is difficult because we will not know exactly how our lifestyle might be in the future. Having a multi-layered strategy like yours will ensure that we have sufficient to enjoy in our later years.

Cheers!