CPF Money That Keeps Compounding

Happy New Year to everyone!

New Year is like the second Christmas to me; season of giving in the form of CPF interests! On every 1st of Jan, interest will be credited into our CPF accounts with interest guaranteed. No matter the performance of the stock/crypto markets, the CPF interest will keep on coming in.

I treat the CPF as another layer in my overall financial strategy; a form of safety net in case my investments go awfully wrong. Risk-free 2.5-5% interest? Sign me up!

Interest Earned

Compound interest really started showing its power. Interest received increased by $1600 compared to last year.

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it

Special Account TopUp

Starting from 1 Jan 22, we would be able to top up $8000 into our own Special/Retirement account and Medisave account up from the previous $7000. Doing so would also allow us to enjoy the tax relief. Previously topping up of Medisave account does not entitle us to tax relief and I'm glad that CPF board changed this.

As part of my plan to quickly attain the Full Retirement Sum (FRS) and enjoy tax relief, did a topup of $8000 to my CPF SA.

Tip: For those who are considering to do the topup, do so in the month of Jan to maximise the interest earned; CPF interest are computed monthly.

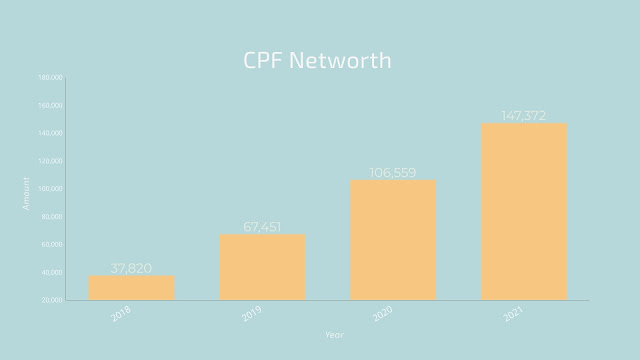

CPF Networth Progress

Looking back its amazing to see how the rate of money growth over time.

2019: +$29,631

2020: +$39,108

2020: +$39,108

2021: +$40,813

After interest and SA Topup, managed to hit $160k!

No withdrawals were made thus far (wish me luck in getting a BTO/SBF). Did some OA to SA transfer over the past few days and the yearly SA topup which explained the higher amount in SA than OA.

FRS Projection

Every year, the retirement sum will be revised to take into inflation and to ensure the amount saved for retirement is sufficient. For 2022, Basic Retirement Sum would be at $96,000 and FRS at $192,000.

Taking a yearly 3% increment in FRS, by the time I turn 55 the FRS would be ~$367,892. This is no small amount and that is why we should capitalise on time and let our money compound.

Based on the courtesy of Value Warrior CPF Calculator, calculations show that I would be able to catch up with the FRS at age 35. Thereafter, the yearly interest in SA would be able to cover the increase in FRS yearly. This is assuming I maintain my current pay and continue with the yearly $8000 SA Topup.

Conclusion

CPF has gained much traction over the past few years with movements like 1M65. People like Mr Loo Cheng Chuan and ASSI have shown that it is indeed possible for the average Singaporean to achieve a substantial amount in their CPF.

I like that CPF is like a passive bond that consistently delivers without much effort on my part. It's a boring yet simple method to sustainably build a safety net for our retirement.

Thanks for reading.

Reaching FRS at 35 would certainly set you up good for retirement. Keep up the good work man!

ReplyDeleteThanks! Good luck on your journey too

Delete